Jul 31, 2020

Jul 31, 2020

Loan Booking, Archival, and Tracking Delays | A Case Study

Follow along as we outline the problems and solutions of one of our clients in this case study synopsis. Then download the case study to learn more.

Month End Loan Booking Troubles

With offices spanning over ten hours in distance from northwest to southeast Texas and continued bank growth, the volume and complexity of uploading files and documents for booked loans, tracking required items, and then producing lender and management exception reports was creating organizational issues. Booking loans at the end of each month took up significant time for loan operations, which made adding staff a real possibility. Loan Operations needed a solution to streamline the loan booking, quality review, and document archival processes in order to be more efficient.

For trailing documents on previously booked loans, all documents were funneled to the back office where manual research to determine what exception a document satisfied was required. Frustration and conflict over missed items or mistakes was causing unnecessary friction between the teams and hampering performance over tedious administrative tasks.

The Integrated Document Management and Exception Tracking Solution

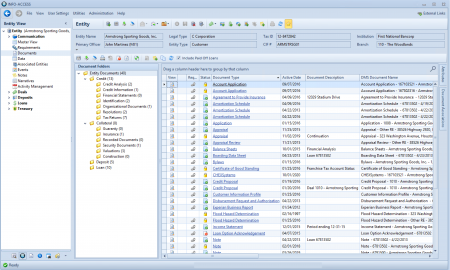

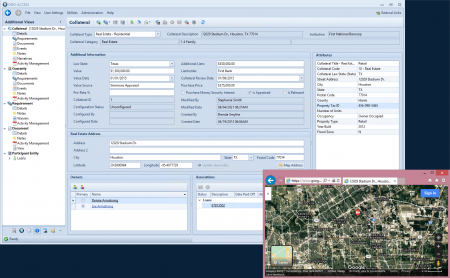

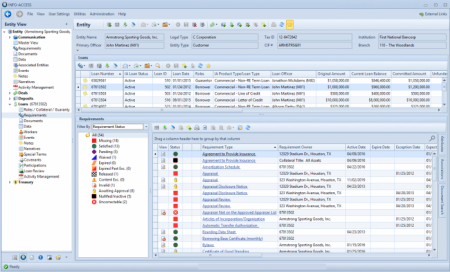

Our client chose to partner with us to integrate the four million documents in their Synergy system with exception tracking, collateral management, workflow process improvements, and review queue functionality using INFO-ACCESS. PROFORMANCE consulted with their team and helped establish best practices for document management, requirement tracking, and document workflow.

Using our Capture Batch Routing solution, the loan operations and credit teams streamlined the end-of-month loan booking process from a two-week process to a one-week process. Newly booked loans are scanned into the solution. Then, the system routes the loan packages through each department for an organized, efficient review. Departments can return packages to the previous group if revisions to their work are needed. When the package has finished flowing through the back-office lending groups, the documents can be seamlessly archived to their DMS. With the bi-directional updates from their DMS and INFO-ACCESS, those documents then automatically satisfy tracked requirements in INFO-ACCESS or are added to exception reports without additional user work.

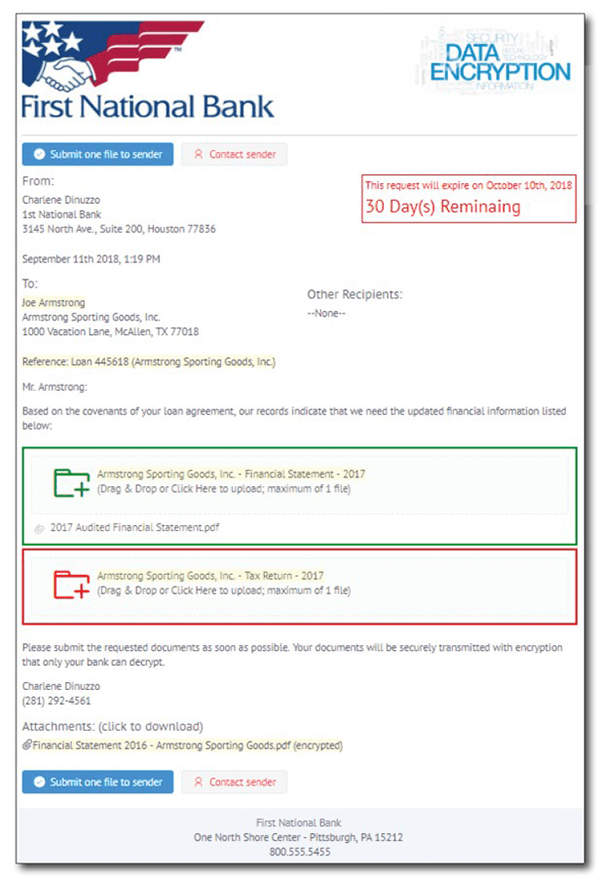

For outstanding requirements, lenders and lending assistants are able to clear their own exceptions by uploading documents to satisfy exceptions using many easy document upload options. The users can even drag & drop a document onto an interactive exception list in INFO-ACCESS and watch their exception list get shorter in real-time. Uploaded documents are flagged for final review and approval by back-office employees, and management reports update automatically.

Benefits of INFO-ACCESS

Download our case study to read about the following benefits in-depth.

- All users now have instant access to all documents and all exception tracking with updates in real-time.

- Gained the ability to maintain a lean back-office lending staff. They saved one FTE in the first year.

- A “one-stop-shop” (as our client puts it) application allows them to work everything all at once – they can create the loan, setup requirements, and review documents all while management reports aggregate new data automatically for them.

- Seeing an up-to-the-minute, on-demand exception list and uploading documents to clear them is a popular feature among the lending team.

- Review queue has saved time for both loan operations and the credit team.

- Lenders and management gained the ability to closely monitor their portfolio using the interactive reporting tools that allow them to produce their own reports pulling in data from the core, the document management system (DMS), exception tracking, collateral management, and more. And, all users can create their own reports with no programming knowledge needed, just point and click.