May 29, 2020

May 29, 2020

Collateral Management System – Benefits and Evaluation Tips

The Importance of Collateral Risk Management

Strong risk management practices are essential to the health and ongoing operations of your financial institution. The cyclical nature of market cycles, from commercial real estate loans to residential real estate lending to asset-based lending to agriculture loans, presents inherent risk to all banks and credit unions, but this is even more pressing for community-based institutions who are not “too big to fail”. A collateral management system can be a powerful tool to management if the right tool is selected and used. Why is this important, and how do you evaluate systems? Let’s take a look:

The value these financial institutions bring to their communities is far-reaching. Oftentimes, they have the unique perspective and flexibility to lend to niche markets in their community, providing a valuable revenue source to the financial institution and a critical funding resource to their local area. But, the burden of sound collateral risk management can be a significant drain on scarce personnel resources. Appropriate board and management oversight for proper portfolio management from credit underwriting to credit risk review to concentration of credit management is key in meeting regulatory standards for safety and soundness and essential for ongoing operations. A management information system that can help with the heavy lifting allows financial institutions to balance risk management with operational efficiency.

Managing Commercial Real Estate Loans, Agriculture Loans, and Asset-Based Lending

When evaluating management information systems, pay special attention to the collateral management module. Most collateral management solutions offer the basics in tracking collateral, and most institutions fail to do a thorough analysis of their needs regarding collateral management needs and problem areas.

Take stock in the processes, personnel, and software your institution uses to manage collateral, and you’ll likely uncover areas where accuracy, operational efficiency, and risk management can all improve. Rather than managing your lending portfolio using a patchwork of systems, spreadsheets, people, and processes, why not leverage a collateral management solution that can both assist you in managing credit risk and make your institution more efficient, easing frustrations, speeding up processes, and improving your net interest margin.

Key Components of a Robust Collateral Management System

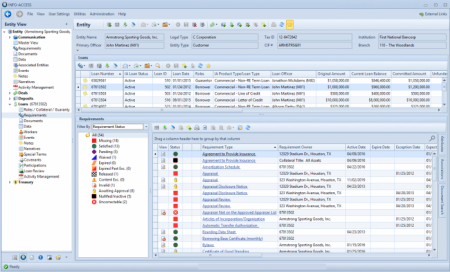

Robust collateral management software should integrate, automate, and minimize risk. Here are some considerations when evaluating collateral management software.

Integrate

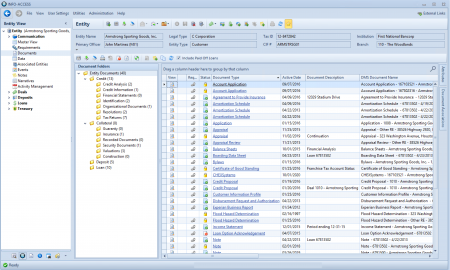

- A management information system that is tightly integrated with your institution’s core processor (like Jack Henry’s Silverlake or Symitar, FIS Horizon CSI, Fiserve, or similar) simplifies and streamlines the day-to-day work of employees throughout the organization.

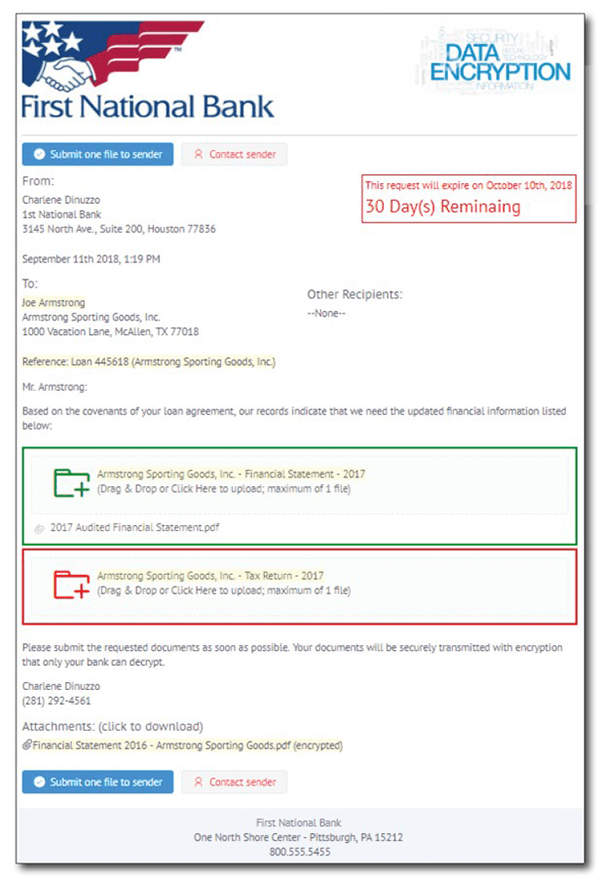

- Presenting a deep range of data from the core keeps employees working in a central application as opposed to flipping from the core to a document management system (DMS) to work managed through spreadsheets. Look for a system that can represent data from your core in a clean and logical layout so that users don’t have to flip around to complete their work.

- By integrating data, a collateral management system can present paid off loans in a work queue where staff can notify a lender of the payoff, prepare a collateral release, automatically remove tracked exceptions, and generate a notice to the customer thanking them for their business without ever leaving the application.

- Leverage these systems to evaluate your loan for HVCRE compliance and track those loans that should be reported. Look for integrations like this so that your collateral management efforts are centralized in one application rather than various spreadsheets.

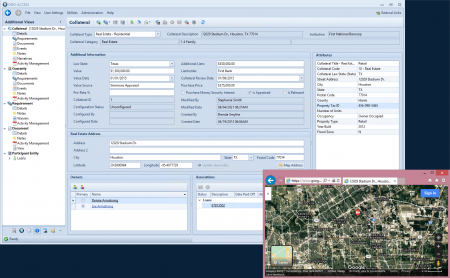

- Your collateral management software should make repetitive work functions, like the geocoding and address mapping of collateral, quick and easy. Select a collateral management system that can streamline these functions.

Automate

- LTV and LTC calculations are more complicated than one loan divided by one value. A strong collateral management system should provide accurate LTV and LTC calculations even where cross-collateralizations exists, allowing your team to stay within regulatory and in-house guidelines. Look for a solution that will provide relational and record-specific calculations viewable on the customer record and integrated with reports.

- Producing collateral management reports can be a time-consuming manual process where employees must record information on spreadsheets and email them around to related departments. Leverage the power of a collateral management system to produce custom reports and schedule them to run automatically so that your staff can focus on other projects.

Minimize Risk

- Concentrations of credit come in many varieties, and most collateral systems aren’t customizable enough to drill-down or track the information that fits your institution. A collateral solution that’s flexible enough to track concentrations of credit by NAICS code to custom collateral concentration codes down to specific attributes that collateral records share will allow your institution to properly manage risk exposures. With this level of granularity, you’ll be able to search, monitor, track, and produce reports on collateral that share the same builder, are in the same subdivision development, or any other unique risk factor that is specific to your bank or credit union.

- Prevent accidental collateral releases on cross-collateralized loans with a solution that clearly presents and tracks cross-pledged collateral. Eliminate user error, like overlooking or misreading a note, by tracking cross-pledged collateral cleanly within the collateral management solution.

Learn More | INFO-ACCESS Collateral Management System

Whether you’re regulated by the OCC, the Federal Reserve, a state banking regulator, or the NCUA, our robust and flexible collateral management system provides the integration, automation, and customization that you need to thoroughly manage the collateral portfolios. We specialize in providing ready-to-go solutions for community-based institutions, and we partner with our clients to set up a collateral management solution that was designed to meet the needs of commercial real estate lending, agriculture lending, asset-based lending, and consumer and residential lending, affording you operational efficiencies without on-staff developers.

Learn more about the INFO-ACCESS enterprise management information system on our website and view the features and functions that will improve your institution’s processes.

Contact us at pfsales@pf-inc.com, and we’ll gladly provide you a free guide to use when evaluating system providers.

Sources/Resources

Comptroller’s Handbook: Concentrations of Credit. (2011, December 13). Retrieved May 29, 2020, from https://www.occ.gov/publications-and-resources/publications/comptrollers-handbook/files/concentrations-of-credit/index-concentrations-of-credit.html